Menu

- Public Policy

- Leadership

- Funding

- News & Events

- About the Center

Back to Top Nav

Back to Top Nav

Back to Top Nav

Back to Top Nav

Accredited as the world’s most powerful bank, the Federal Reserve’s concentration of power is positively linked to global financial markets and our own economic success or failure. An efficient financial system plays a significant role in GDP growth and American prosperity, while adverse financial setbacks can have catastrophic effects on economic activity and employment. Recent controversy has erupted over the Fed’s lack of transparency; during the primaries, both Bernie Sanders and Hillary Clinton endorsed proposals to reform the structure of the Fed. Additionally, federal reform is now included in the Democratic platform. How will these prospective changes affect our Federal Reserve, the American economy, and global financial markets?

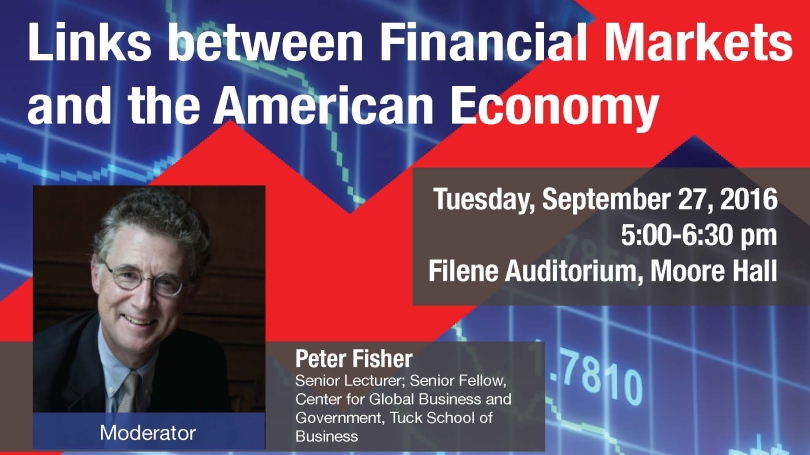

On Tuesday, September 27th, this macrofinancial symposium analyzed the relationship between the financial system and the broader economy. The panelists characterized key elements of these linkages and discuss recent and prospective changes in the supervision and regulation of the financial system. They discussed how these changes will aid the mitigation of systemic risks and promote sustainable and equitable economic growth.

The panelists included Annamaria Lusardi, the Denit Trust Chair of Economics and Accountancy at the George Washington University School of Business (GWSB). She was also awarded the 2015 Financial Literacy Award from the International Federation of Finance Museums and the 2014 William A. Forbes Public Awareness Award from the Council for Economic Education.

Jeremy C. Stein is the Moise Y. Safra Professor of Economics at Harvard University, where he teaches courses in the undergraduate and PhD programs, and serves on the board of directors of the Harvard Management Company. From May 2012 to May 2014, Stein was a member of the Board of Governors of the Federal Reserve System. His research covers behavioral finance and market efficiency, corporate investment and financing decisions, risk management, capital allocation inside firms, financial regulation, and monetary policy. In 2009, Stein served as a senior advisor to the Treasury Secretary and on the staff of the National Economic Council.

Egon Zakrajšek is a Senior Adviser in the Division of Monetary Affairs on the Board of Governors of the Federal Reserve System in Washington, DC. As a member of the division’s senior management team, his responsibilities include providing policy advice and guiding staff in their analysis of issues pertaining to the interaction between financial market conditions and economic activity, the transmission of monetary policy through financial markets and institutions, and interactions between monetary policy and financial stability.

The panel’s moderator was Peter R. Fisher, a Senior Fellow and lecturer at the Center for Global Business and Government at the Tuck School of Business at Dartmouth. He is a member of the Board of Directors of AIG, of the Peterson Institute for International Economics, and of the John F. Kennedy Library Foundation. Fisher served as Under Secretary of the U.S. Treasury for Domestic Finance from 2001 to 2003 in addition to working at the Federal Reserve Bank of New York from 1985 to 2001.

Submitted by Alexa Green ’19, Rockefeller Center Student Program Assistant for Public Programs

The views and opinions expressed and any materials presented during a public program are the speaker’s own and do not necessarily represent the views and opinions of the Rockefeller Center or constitute an endorsement by the Center.